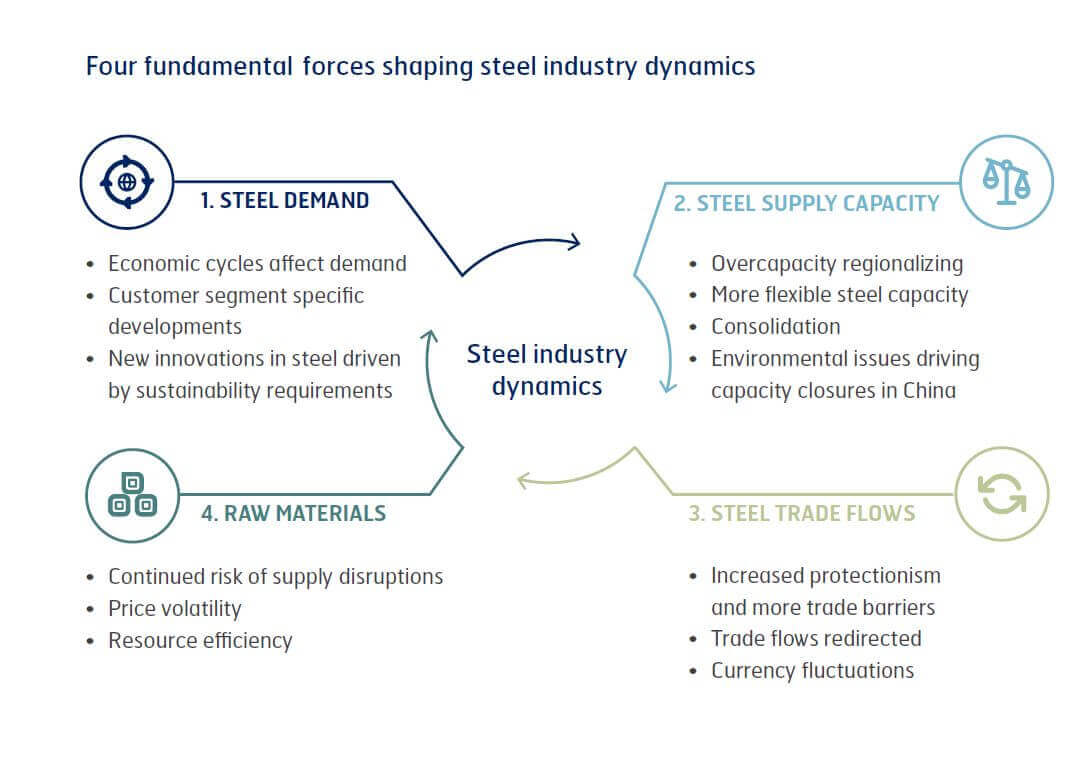

Steel industry dynamics are shaped by global trends in steel demand, steel supply capacity, steel trade flows and the raw material markets. These in turn are influenced by global megatrends such as climate change and resource scarcity, population growth, urbanization and digitalization.

Four fundamental forces shaping steel industry dynamics

1. Steel demand

Global steel demand taking a severe hit due to Covid-19

Steel demand started to show signs of improvement in early 2020 after a challenging second half of 2019, but soon faced severe headwinds due to the coronavirus outbreak. In general, apparent steel demand held up relatively well in the beginning of the outbreak as customers restocked to mitigate future supply disruptions, but demand then dropped sharply across most markets and segments. Key steel-using segments, such as the automotive sector, ceased production completely during parts of the year because of the lockdown measures introduced in multiple countries. Furthermore, weak end-user demand and supply chain disruptions continuously caused challenges in most segments throughout the year. Steel demand started to steadily pick up toward the end of the year, but a recovery to pre-Covid-19 levels is expected to take time. China has demonstrated the fastest pace of recovery, while Europe and the US, for example, have shown a more moderate pace by comparison.

Global megatrends and industry-specific trends shape customer demand across all industries, including the steel industry. For example, users in the construction and automotive industries are working at lower costs, improving safety and lightening the weight of their products, thereby reducing their environmental impact. In the mining industry, customers are striving to increase the durability of equipment and reduce downtimes. The use of high-strength steels provides advantages in the form of stronger, lighter and more durable steel solutions. Use of these steels therefore continues to increase and has a higher growth potential than standard steels. Furthermore, multiple steel-using segments are showing a growing interest in low CO2 steel, where steel companies are now investing to bring solutions to market to meet strong customer demand.

2. Steel supply capacity

Industry taking action to balance supply and demand after the drop in the market

Excess steel production capacity, especially in China, but also in Europe, has been impacting steel industry dynamics since the financial crisis of 2008. However, apparent demand and effective capacity have become more balanced in recent years. Going into 2020, market expectations looked favorable until the pandemic started to unfold.

In most of the world, the steel industry was forced to take short-term actions to cope with declining demand. This included idling a large number of blast furnaces, taking outages at EAF facilities, and part time layoffs of employees. In some cases, blast furnaces have been permanently closed. Notably, the Chinese authorities worked actively to improve their domestic situation by stimulating demand, with a variety of stimuluses to fuel economic recovery and reduce the effect on the steel industry.

Supply landscape transformationThe year 2020 saw the continuation of a number of regional trends in how the supply landscape is transforming. In Europe, there is a strong push toward green technologies and more sustainable steelmaking processes. Despite talks of consolidation between steel companies, no large deals were announced. In the US, a number of greenfield initiatives to build new electric arc furnace mills continues. The US flat carbon steel market also saw the emergence of a new large steel company since the mining company Cleveland-Cliffs forward-integrated by acquiring AK Steel and most of the US assets from ArcelorMittal. In Asia, consolidation continues and Baowu overtook ArcelorMittal as the world’s largest steel company.

3. Steel trade flows

Global trade patterns have been scrutinized and debated in recent years, resulting in more and more countries installing protection mechanisms. The introduction of trade barriers was growing worldwide already before the coronavirus outbreak and the number of global trade cases has increased in recent years. Section 232 tariffs in the US may be the best-known measure, but several other regions have also introduced retaliatory measures. Additional measures were introduced during the coronavirus outbreak to better control flows of imported steel. This can be seen for example in Europe, where country-specific import quotas were used to a greater extent than earlier. Substantial trade policies will likely be in force for a number of years, and more may be introduced if perceived necessary to curb predatory trade practices. As such, they may dampen economic growth prospects and/or hinder exports of niche materials, but should, on the other hand, at least in the short term, be supportive of steel prices in home markets.

Market regionalizationTrade policies combined with increasing steel demand locally have resulted in decreased trade, particularly between geographical regions. Extra-regional steel trade (i.e. excluding trade within the EU, NAFTA, CIS, etc.) has been on a downward path in recent years and accounted for 14% of global steel demand in 2019, down two percentage points from 2018. The US remains the largest net importer of steel, with a trade deficit of about 20 million tonnes in 2019, whereas Europe had a trade deficit of about 12 million tonnes. It is notable that China, which has historically been a major net exporter of steel, has been a net importer during parts of 2020 following a strong domestic demand recovery. The coronavirus outbreak could be a further catalyst of market regionalization as companies may consider localizing supply chains and further trade policies may be introduced to save local jobs and support a green re-start of the economy, e.g. through carbon border taxes.

4. Raw materials

During 2019, iron ore prices rose to recent record levels. However, during the first part of 2020 iron ore prices started to come down only to sharply reverse upward during the second half of 2020. The main drivers for the increase in iron prices were production disruptions from some of the major low-cost producers, coupled with high demand based on high Chinese steel output rates. The combination meant that producers higher up on the cost curve had more influence over global iron ore prices. High iron ore prices had a negative effect on steel production profitability as producers were unable to pass on the increased costs to customers.

Steel prices

Steel demand, steel supply capacity, steel trade flows and input materials all impact the sales prices of steel products globally. Steel prices have been increasingly volatile and unpredictable in recent years and the Covid-19 pandemic has not contributed to stabilize prices. Looking at the prices during 2020, hot-rolled coil spot steel prices fell about 10% in Europe from the start of the year until the end of summer, at which point they started to recover and ended up 40% higher than the starting point of the year. Standard plate prices were especially affected, falling at the beginning of the year, but also recoiled and plate prices have increased by about 15% in Europe and close to 22% in the Americas.